25% mark and the power behind set principles

Since quarantine, life itself has been a big challenge. Literally everyone I know has been affected from COVID-19. The truth is how you're willing to handle it.

I'm not a rich man. I'm not someone who has fancy items or flashy clothing. I'm a simple man and I prefer a simpler life. I like it simple because I abide to principles that help me be successful. Others, they prefer to live a life that believes debt is okay. Others prefer to not pay the bill on time but rather wait until they get the final notice and then they're on the phone with a company that can give two nickels about how successful you are. There's one thing I've noticed, no matter how far you're down, no matter if you lose your job, your livelihood, your well-being, your mental state, there's not going to be a lot of people coming to your rescue. Expect people to give you the big "that sucks" and then move on because they have their own life to worry about.

I always remember what Ian Maclaren said in 1897, "Be pitiful, for everyone you meet is fighting a hard battle." You may have heard or seen on some social media platform that Plato said something slightly different. Who cares! What you should be worrying about is YOURSELF and YOUR FINANCES! Regardless, for the rest of the world, leave them alone. Leave them be! Let them do their own thing.

You're probably thinking I'm some heartless person who can care less about the well being of others. Absolutely not. My perspective is people who are content with their lives and their choices is none of my business. If someone wants to pursue a career in engineering or crime, that's their life. If they choose to do absolutely nothing, that's fine by me. I carry no water to it. Now don't get me wrong, I love helping people. But you must give them the space and time for them to ask and you must be kind enough to initiate it. And don't overstep your own spirit, belief, or continue when you want to stop. It is okay to say no and it is okay to establish ground rules. It's tough for me to see someone on the side of the road, begging for my loose change. Truthfully it's up to my attitude at the time if I decide to help them. But if I refuse, that doesn't make me a bad person and it shouldn't make you a bad person. All of us help in many ways. I'm hoping that this blog helps you with your life. I'm hoping that you'll be able to be financially prepared for the world and deal with your problems accordingly. Always remember the great Taoist philosopher Alan Watts, "You're under no obligation to be the same person you were 5 minutes ago."

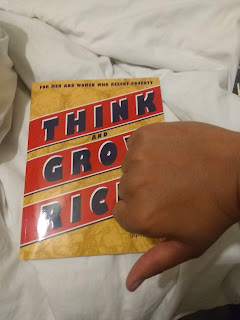

Two new things: I'm trying to read Napoleon Hill's famous money book Think and Grow Rich. To me, it's a ripoff. I feel like the entire lesson he's trying to teach you can be summed up in one line: Love what you do and go after it. Don't bother reading it. Thumbs DOWN!

For the summer, read something fun or exciting. Find something fresh or get a magazine subscription instead. I'm currently reading Surely, You're Joking, Mr. Feynman! from the famous physicist Dr. Richard Feynman. It's a great book that follows his adventures as a kid to when he was helping the United States with the Manhattan Project. If you're wanting a good laugh, find him on some Youtube videos before picking up the book. It's a great read and it gives my eyes a break from looking at stocks and the news. BIG THUMBS UP!

The second item is I reached my 25% mark on stocks. In fact I've hit 26.2% since I've revamped my portfolio. Here's my next point: principles. I figure I might as well talk about how to buy the right stocks, or at least how I do it...

My personal principles on stock:

1. Find a stock you like reading about. Maybe it isn't a buy, but reading about new products, services or different ways a company fits in with the rest of the world is always a plus. I've always been a big fan of SpaceX, despite Elon Musk being kind of a strange man. I think what the company is doing is absolutely innovative and powerful, which is making us one step closer to regular space travel. Not to mention their Starlink Project and Tesla motors, the list goes on and on. But reading the gossip of your potential money makers allows you to be genuinely interested.

2. Do not let your bias get in the way. I had a friend who was a hardcore AMD fanboy. He despised Intel. His energy rubbed on me and although I owned AMD, Intel stock went up. When I first started buying stock, I held a lot of biases on companies all because someone mentioned it or I saw it on some social media post. It was ridiculous. I later found out Intel had dividends and they were an excellent competitor to AMD, making them an easy buy. Your biases can literally get you to lose large sums of money in the long run.

3. Buy a reputable, reliable company that is trending up. Trending up is a big indicator. Don't expect your company to drastically fill your pockets with gold quickly. Instead you should be looking at it's trend and you should be figuring out why it's trending in that way. My big mistake about a decade ago was buying this company that cornered the market in almost all the credit and debit cards. They were the largest manufacturer of plastic cards, from your bank card to those throwaway gift cards you'd use for any purchase. I thought wow, this company has the edge on plastic, what an easy buy! I failed to see their stats because I failed to do my homework. I later found out why the company was losing money slowly: people don't use their cards once and toss them, they keep them for two years. Imagine Burger King taking two years to serve a meal. No wonder the stock was cheap, they weren't moving product! And the product was a piece of plastic with a magnetic strip. You can make it practically anywhere! So when you find a company, make sure it's going up and make sure you do your homework first! No rush in winning money!

4. Wait for a day when the market is in the red and buy up. I always like "down" days because there's a good chance it'll bounce back to a supporting price, which in your case, you're already in the green. Make sure it's red because of the larger markets and not because they found out the CEO is involved in some scandal. If you see the DJIA or Nasdaq is losing points, those are the days the water is low. Dive in and wait for the tide to come.

5. Don't expect to get rich. Now notice, I didn't say don't expect to get rich quick or get rich in the next few years. A lot can happen and many times, if your finances are not in check, chances are you're going to be pulling out money to pay for this or that. So don't expect to be rich or get rich. In fact when you buy something, ignore it. Pretend the money is lost in the digital cyberspace and you're poor. It's better for you that way. Stay humble and don't call yourself a "trader" - by no means you're not living in New York or wear a $3000 suit, you're a nobody with a regular life. Deal with it.

6. Sell when you lose 8% or more from the stock. The 8% mark I steal from the CANSLIM method. This is a major logistic principle that helps you keep some of your loses. I've only broken this rule once and it was right around March, when the stock market fell from the sky. I will never do it again. Luckily I've recouped my loses and gained a few bucks along the way.

7. Continue doing research, even on stocks you've looked away before. Sometimes companies change and when they do, they change for the better. It's a cutthroat world out there in corporation land. Some companies dry up while others bloom out of the concrete. Keep your eyes open for any possible shifts in the sand and abide to your principles. Snapchat and I have a rough history. I bought at the high, sold at the low, when they rose up I bought more and it went plateau on me. I sold and they went up. Had I followed my principles, I would've been a happy clam.

8. Regard where the stock is coming from. To me, China is the largest economic gear we have on Earth. If China moves, as does the universe. A large portion of my portfolio is China-based investments. You know why? Because China owns a lot of leverage. What do they build? Practically everything! Who's paying for it? You! Me! Everyone I know! Always find out where your stock is coming from and where it's based and if they have money coming through.

9. Make your investments automatic and monthly. I've learned the more stocks I have the more money I have. More money means more options. Had I loosely tossed a few bucks here and there I'd still only have just a few bucks here and there to invest it. It's not even investing. I'm not taking it seriously when I do that. If you're serious, then get serious! Make investments like you're paying a bill. Deal with it later when you're wondering how you managed to save up tens of thousands.

10. Always use a reputable broker and make sure they have a good app for your phone. If you're old school and you're trading off a laptop, that's fine but stocks can shift quickly and you'd like to have access to your money at the tips of your fingers daily, just in case. Make sure you have a platform that is reliable. Robinhood lost me a few months back when they had a "server error" that hit their accounts, freezing everyone's trades for a day and all they did was give you a discount on your investments. Bullshit! Get a good platform that's reliable. Just because it looks fancy doesn't mean it is. Just because it's simple doesn't mean you should use it. Simple tells me that they think I'm stupid. You're not stupid, you're reading this blog. That tells me you're willing to change your behavior.

I hope this information helps you. I hope you're doing great out there. Recently I was looking at my stats and I noticed there's been a lot of activity coming from Romania? Strange! Well, hello to all my Romanian friends! Take care!

Adam

I'm not a rich man. I'm not someone who has fancy items or flashy clothing. I'm a simple man and I prefer a simpler life. I like it simple because I abide to principles that help me be successful. Others, they prefer to live a life that believes debt is okay. Others prefer to not pay the bill on time but rather wait until they get the final notice and then they're on the phone with a company that can give two nickels about how successful you are. There's one thing I've noticed, no matter how far you're down, no matter if you lose your job, your livelihood, your well-being, your mental state, there's not going to be a lot of people coming to your rescue. Expect people to give you the big "that sucks" and then move on because they have their own life to worry about.

I always remember what Ian Maclaren said in 1897, "Be pitiful, for everyone you meet is fighting a hard battle." You may have heard or seen on some social media platform that Plato said something slightly different. Who cares! What you should be worrying about is YOURSELF and YOUR FINANCES! Regardless, for the rest of the world, leave them alone. Leave them be! Let them do their own thing.

You're probably thinking I'm some heartless person who can care less about the well being of others. Absolutely not. My perspective is people who are content with their lives and their choices is none of my business. If someone wants to pursue a career in engineering or crime, that's their life. If they choose to do absolutely nothing, that's fine by me. I carry no water to it. Now don't get me wrong, I love helping people. But you must give them the space and time for them to ask and you must be kind enough to initiate it. And don't overstep your own spirit, belief, or continue when you want to stop. It is okay to say no and it is okay to establish ground rules. It's tough for me to see someone on the side of the road, begging for my loose change. Truthfully it's up to my attitude at the time if I decide to help them. But if I refuse, that doesn't make me a bad person and it shouldn't make you a bad person. All of us help in many ways. I'm hoping that this blog helps you with your life. I'm hoping that you'll be able to be financially prepared for the world and deal with your problems accordingly. Always remember the great Taoist philosopher Alan Watts, "You're under no obligation to be the same person you were 5 minutes ago."

Two new things: I'm trying to read Napoleon Hill's famous money book Think and Grow Rich. To me, it's a ripoff. I feel like the entire lesson he's trying to teach you can be summed up in one line: Love what you do and go after it. Don't bother reading it. Thumbs DOWN!

For the summer, read something fun or exciting. Find something fresh or get a magazine subscription instead. I'm currently reading Surely, You're Joking, Mr. Feynman! from the famous physicist Dr. Richard Feynman. It's a great book that follows his adventures as a kid to when he was helping the United States with the Manhattan Project. If you're wanting a good laugh, find him on some Youtube videos before picking up the book. It's a great read and it gives my eyes a break from looking at stocks and the news. BIG THUMBS UP!

The second item is I reached my 25% mark on stocks. In fact I've hit 26.2% since I've revamped my portfolio. Here's my next point: principles. I figure I might as well talk about how to buy the right stocks, or at least how I do it...

My personal principles on stock:

1. Find a stock you like reading about. Maybe it isn't a buy, but reading about new products, services or different ways a company fits in with the rest of the world is always a plus. I've always been a big fan of SpaceX, despite Elon Musk being kind of a strange man. I think what the company is doing is absolutely innovative and powerful, which is making us one step closer to regular space travel. Not to mention their Starlink Project and Tesla motors, the list goes on and on. But reading the gossip of your potential money makers allows you to be genuinely interested.

2. Do not let your bias get in the way. I had a friend who was a hardcore AMD fanboy. He despised Intel. His energy rubbed on me and although I owned AMD, Intel stock went up. When I first started buying stock, I held a lot of biases on companies all because someone mentioned it or I saw it on some social media post. It was ridiculous. I later found out Intel had dividends and they were an excellent competitor to AMD, making them an easy buy. Your biases can literally get you to lose large sums of money in the long run.

3. Buy a reputable, reliable company that is trending up. Trending up is a big indicator. Don't expect your company to drastically fill your pockets with gold quickly. Instead you should be looking at it's trend and you should be figuring out why it's trending in that way. My big mistake about a decade ago was buying this company that cornered the market in almost all the credit and debit cards. They were the largest manufacturer of plastic cards, from your bank card to those throwaway gift cards you'd use for any purchase. I thought wow, this company has the edge on plastic, what an easy buy! I failed to see their stats because I failed to do my homework. I later found out why the company was losing money slowly: people don't use their cards once and toss them, they keep them for two years. Imagine Burger King taking two years to serve a meal. No wonder the stock was cheap, they weren't moving product! And the product was a piece of plastic with a magnetic strip. You can make it practically anywhere! So when you find a company, make sure it's going up and make sure you do your homework first! No rush in winning money!

4. Wait for a day when the market is in the red and buy up. I always like "down" days because there's a good chance it'll bounce back to a supporting price, which in your case, you're already in the green. Make sure it's red because of the larger markets and not because they found out the CEO is involved in some scandal. If you see the DJIA or Nasdaq is losing points, those are the days the water is low. Dive in and wait for the tide to come.

5. Don't expect to get rich. Now notice, I didn't say don't expect to get rich quick or get rich in the next few years. A lot can happen and many times, if your finances are not in check, chances are you're going to be pulling out money to pay for this or that. So don't expect to be rich or get rich. In fact when you buy something, ignore it. Pretend the money is lost in the digital cyberspace and you're poor. It's better for you that way. Stay humble and don't call yourself a "trader" - by no means you're not living in New York or wear a $3000 suit, you're a nobody with a regular life. Deal with it.

6. Sell when you lose 8% or more from the stock. The 8% mark I steal from the CANSLIM method. This is a major logistic principle that helps you keep some of your loses. I've only broken this rule once and it was right around March, when the stock market fell from the sky. I will never do it again. Luckily I've recouped my loses and gained a few bucks along the way.

7. Continue doing research, even on stocks you've looked away before. Sometimes companies change and when they do, they change for the better. It's a cutthroat world out there in corporation land. Some companies dry up while others bloom out of the concrete. Keep your eyes open for any possible shifts in the sand and abide to your principles. Snapchat and I have a rough history. I bought at the high, sold at the low, when they rose up I bought more and it went plateau on me. I sold and they went up. Had I followed my principles, I would've been a happy clam.

8. Regard where the stock is coming from. To me, China is the largest economic gear we have on Earth. If China moves, as does the universe. A large portion of my portfolio is China-based investments. You know why? Because China owns a lot of leverage. What do they build? Practically everything! Who's paying for it? You! Me! Everyone I know! Always find out where your stock is coming from and where it's based and if they have money coming through.

9. Make your investments automatic and monthly. I've learned the more stocks I have the more money I have. More money means more options. Had I loosely tossed a few bucks here and there I'd still only have just a few bucks here and there to invest it. It's not even investing. I'm not taking it seriously when I do that. If you're serious, then get serious! Make investments like you're paying a bill. Deal with it later when you're wondering how you managed to save up tens of thousands.

10. Always use a reputable broker and make sure they have a good app for your phone. If you're old school and you're trading off a laptop, that's fine but stocks can shift quickly and you'd like to have access to your money at the tips of your fingers daily, just in case. Make sure you have a platform that is reliable. Robinhood lost me a few months back when they had a "server error" that hit their accounts, freezing everyone's trades for a day and all they did was give you a discount on your investments. Bullshit! Get a good platform that's reliable. Just because it looks fancy doesn't mean it is. Just because it's simple doesn't mean you should use it. Simple tells me that they think I'm stupid. You're not stupid, you're reading this blog. That tells me you're willing to change your behavior.

I hope this information helps you. I hope you're doing great out there. Recently I was looking at my stats and I noticed there's been a lot of activity coming from Romania? Strange! Well, hello to all my Romanian friends! Take care!

Adam

Comments

Post a Comment